Bulgaria is in Southeast Europe, on the Balkan Peninsula, with a Black Sea coastline.

It’s a member of the EU, which makes it attractive for foreign property investors.

Popular Locations for Property Investment:

Sofia: The capital is the most expensive and in-demand — modern apartments, high-quality new builds.

Black Sea Coast: Cities like Varna, Burgas, and resort towns (e.g., Sunny Beach, Nesebar, Sozopol) are very popular for holiday homes.

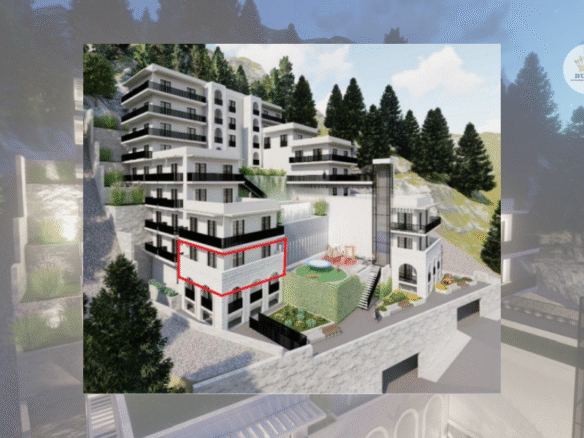

Mountain Resorts: Places like Bansko and Razlog are attractive for vacation properties, especially for ski tourism.

Secondary Cities: Plovdiv is gaining traction, especially for long-term investment, due to its cultural scene and growing economy.

Property Types:

New apartments in modern residential complexes.

Vacation apartments / holiday homes on the coast.

Mountain resort apartments (ski / second homes).

Built-to-rent projects (newer trend) — professionally managed residential buildings.

Foreign Ownership:

Foreigners can buy property in Bulgaria quite freely, especially non-agricultural land and apartments.

For agricultural land there may be restrictions.

Price Trends & Market Dynamics (Mid-2025)

Strong Price Growth:

According to Eurostat, Bulgaria recorded a 15.1% increase in house prices in Q1 2025 compared to Q1 2024 — second-highest in the EU.

In Sofia, prices have more than doubled over the last 10 years: from ~€715/m² in 2015 to over €2,100/m² in early 2025.

Other cities: Varna and Plovdiv have also seen significant increases (~120 % and ~150 % respectively over the past decade).

Regional Price Levels (Approximate):

Sofia: ~€1,500–€1,900/m² in many areas; in prime/new areas goes over €2,000.

Varna (Coastal): Prices in some areas ~€1,280/m² (according to one forecast).

Burgas (Coastal): ~€1,000–€1,300/m² in some parts.

Mountain (Bansko): Much more affordable; lower-tier mountain apartments can start from ~€500–€800/m² in some cases.

Rental Yields:

Rental yields are moderately lower: average gross rental yield in Bulgaria is ~4.56% (Q2 2025) per one source.

In the most touristy/coastal areas, seasonal rental demand is strong, especially in well-managed holiday complexes.

Mortgage & Finance:

Mortgages are an increasingly important part of real estate buying: in Sofia, about 73% of apartment purchases are mortgage-financed.

Mortgage rates are relatively low (for Bulgaria) — some standard housing loans in BGN are between ~2.6% and ~4.2%.

Drivers & Risks

Growth Drivers:

Euro Adoption: Bulgaria is expected to adopt the euro soon, which is increasing investor confidence, reducing currency risk, and potentially driving more demand.

Tourism Demand: Coastal areas and mountain resorts benefit from tourism, boosting demand for holiday homes.

Foreign Interest: Growing purchases by non-residents (from Germany, UK, Netherlands, Israel, etc.).

Sustainability & Modern Living: New developments focus on energy efficiency, green areas, and modern amenities.

Risks / Challenges:

Rental Yields Slipping: As prices rise faster than rents, gross yields are under pressure.

Affordability: Rising prices may make it harder for local buyers; some segments already showing signs of slowing growth.

Regulatory / Credit Risk: Changes in mortgage rules (e.g., limits on loan-to-value or monthly payment ratios) could affect buyers.

Regional Imbalance: Some secondary cities are now heating up fast, but rural or depopulating areas remain less attractive, which may lead to speculative risks.

Recent & Emerging Trends (2025)

Stabilization of Growth: While prices are still rising, the pace is slowing compared to earlier surges.

Strong Demand for Middle-Segment Apartments: 2-3 room apartments make up a large share of transactions; there is a shortage in the mid-price segment.

Built-to-Rent (BTR): Increasing interest in professionally managed rental buildings.

Holiday Property Boom: The Black Sea coast and mountain towns are especially attractive for both domestic and international buyers.

Foreign Transactions: A growing proportion of buyers are non-Bulgarian, helping to sustain high demand.

Investment Outlook

Short-to-Medium Term (1–5 years): Likely continued price appreciation, though at a more moderate rate (many analysts expect ~8–10% growth in 2025).

Long-Term (5–10+ years): If euro adoption and EU integration deepen, Bulgarian property could remain a strong value play, especially in growing cities and tourism hotspots.